Lam Nguyen

About Me

Lehigh University, Class of 2026

College of Business – Finance and Business Analytics

Portfolio

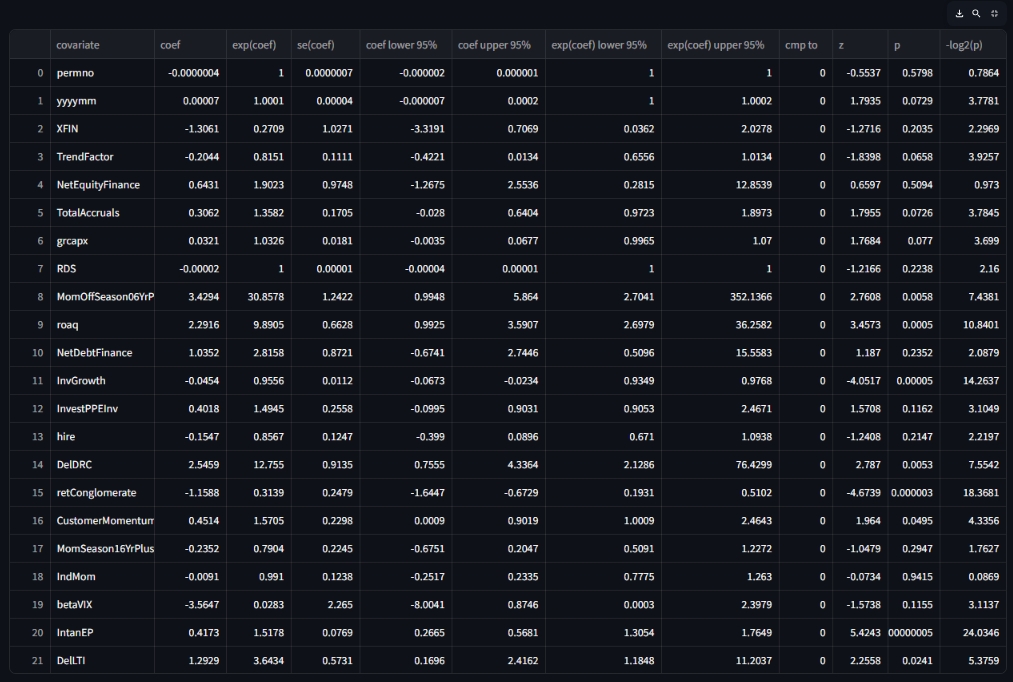

📈 Stock Return Survival Analysis

This analysis uses the Cox Proportional Hazards model to evaluate financial signals. Hazard ratios (exp(coef)) indicate how each signal affects the risk of stock delisting:

- Hazard ratio > 1 → Higher risk of being delisted (shorter survival)

- Hazard ratio < 1 → Lower risk (positive survival)

Example: Total Accruals

A ratio > 1 means higher accruals increase the chance of delisting or financial distress.

Significance is determined at p < 0.1.

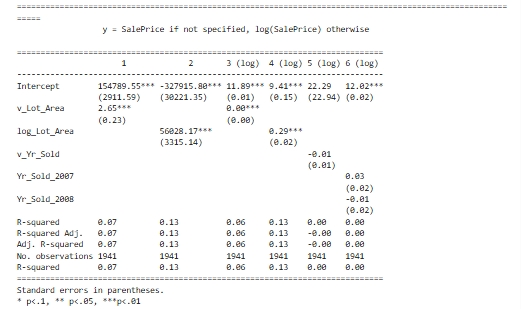

📊 Regression Practice

This was an exercise in interpreting regression outputs. The model regressed Lot Area and Year Sold on Sales Price.

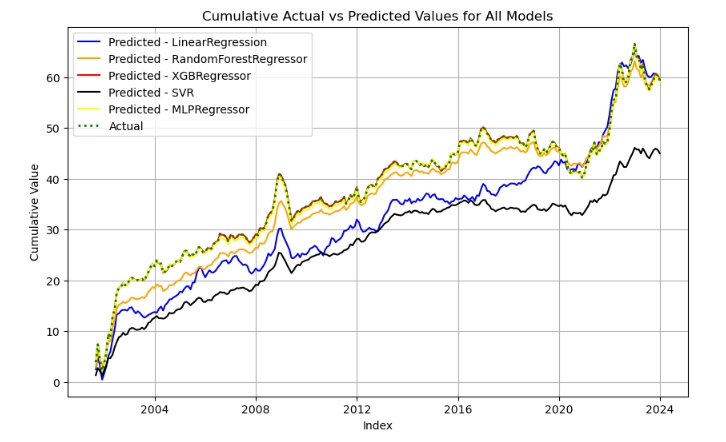

🤝 Team Project: Stock Prediction Analysis

This project compares cumulative returns of signal-level portfolios using the OpenAP library and several ML models:

- Linear Regression

- MLP Regressor

- Random Forest

- SVR (Support Vector Regressor)

- XGBoost

Career Objectives

Aspiring finance and analytics professional pursuing a B.S. in Finance and Business Analytics at Lehigh University. I aim to leverage financial modeling, investment analysis, and data science to add value in private equity, venture capital, or financial consulting. Passionate about delivering data-driven insights and sustainable investment strategies on a global scale.

Hobbies

🎵 Music Production

🏋️♂️ Gym & Fitness

🏀 NBA Fan – Lifelong supporter of the Golden State Warriors

📬 Contact

- Email: ngoclamnguyenpham@gmail.com

- Phone: (484) 767-0534

- Location: Bethlehem, PA